Are you looking for a simple and effective way to boost your savings? If so, the bi-weekly savings challenge might be just what you need.

In this blog post, we’ll explain what the bi-weekly savings challenge is, how it works, and why it’s such a great way to save money especially if you are paid bi-weekly (roughly every two weeks).

Want more money saving ideas? Check out our Best Money Savings Challenges.

What is the Bi-Weekly Savings Challenge?

The bi-weekly savings challenge is a way to save money by setting aside a small amount of money every two weeks. The idea is to make saving money a habit, rather than something you only do once in a while. This works perfect for those who are paid bi-weekly or every two weeks.

How Does the Bi-Weekly Savings Challenge Work?

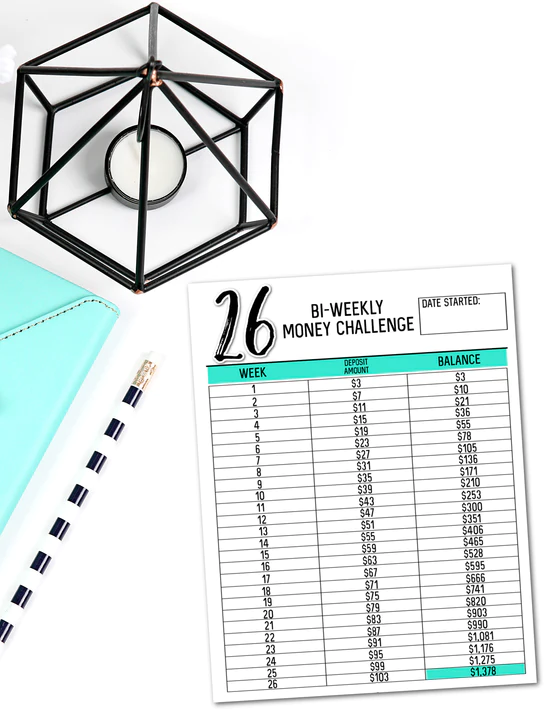

The bi-weekly savings challenge is very easy to participate in. Since there are 26 bi-weekly weeks in a year, you’ll save every two weeks.

Now, you can certainly save any amount you want but for the ease of saving, I created a bi-weekly savings challenge that is ready to go for you.

On week 1 you’ll save $3, on week 2 you’ll save $7, on week 3 you’ll save $11 – see the pattern?

By the end of the full 26 weeks of saving, you’ll have saved $1,378!!

The key to making the bi-weekly savings challenge work is to be consistent. So even if you have to skip a week, pick up the amount the following week.

I made you a 26 Bi-Weekly Savings Chart here.

How to Store Money Saved During The Bi-Weekly Savings Challenge

You can save your money for this challenge with two ways – digitally or physically.

Now, if you are someone who will just transfer money as needed out of your savings and into your checking, do it physically.

I like doing the physical method and use 26 envelopes, a cute storage box and some stickers.

If you’d rather, you can also just transfer money from your checking into a dedicated savings account for this challenge. Just make sure to not touch the money.

@simplisticallyliving Bi-Weekly Money Saving Challenge! #budget #budgethacks #moneychallenge #100envelopechallenge #savingmoney #fyp #money #LearnOnTikTok ♬ Get On It – Chris Alan Lee

Why is the Bi-Weekly Savings Challenge a Great Way to Save Money?

There are several reasons why the bi-weekly savings challenge is such a great way to save money:

It’s easy to get started: All you need to do is, figure out how you can make the amounts work in your current budget with your paychecks every two weeks.

It’s doable: Some money savings challenges require more money, more frequently. This challenge is perfect because it’s spread out over 26 weeks giving you more time to save.

It’s a habit: By setting aside a small amount of money each pay period, you’ll be forming a savings habit that will help you save more money in the long run.

It adds up: Even though you’re only setting aside a small amount of money each pay period, it can add up quickly. You can even do the savings challenge backwards to get the bigger amounts out of the way.

Tips for Making the Bi-Weekly Savings Challenge Work for You

- Automate your savings: Set up an automatic transfer from your checking account to your savings account so you don’t have to remember to transfer the money manually each pay period.

- Use a budgeting app: There are many budgeting apps that can help you track your spending and stay on track with your savings goals.

- Find ways to cut expenses: Look for ways to cut expenses in your budget so you can free up more money to save.

- Make it a game: Try to see how fast you can complete this challenge (if you decide to complete it sooner than the 26 weeks). This can make saving money more fun and rewarding.

In conclusion, the bi-weekly savings challenge is a simple and effective way to boost your savings. By setting aside a small amount of money every two weeks, you’ll be forming a savings habit that can help you save more money in the long run. Give it a try and see how much you can save!