When it comes to your money, there is no “one-size fits all” approach. While I do love Dave Ramsey and have followed his baby steps program for years, I am here to tell you, it’s not for everyone.

Now, if you’ve landed here because you are a baby stepper yourself, you are probably rolling your eyes and are about ready to let loose in the comments but please hold that thought and here me out… I am not here to talk you out of your gazelle intense strategy.

Instead, I am only here to tell people THERE IS ANOTHER WAY.

You see, I am a person that likes to have options when it comes to making very important decisions in my life. In fact, if I feel pushed into a corner, I will find a tiny hole and dig my way out.

Why?

Because I don’t think that any one way is the right way simply because, everyone’s lives and choices they make, are different.

So, let me get back to my point, Dave Ramsey’s Baby Steps Is Not For Everyone and I am about to tell you why…

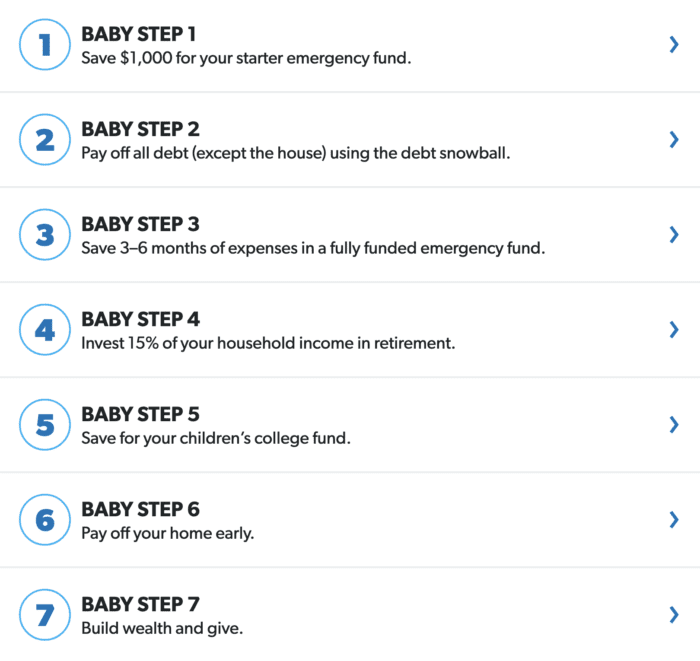

The Dave Ramsey 7 Baby Step’s are designed to help you get out of debt, save money and build wealth. Something just about everyone needs.

However, when you take a look at those steps you can immediately see how some of them may seem almost impossible to reach:

Most people that begin this journey are able to complete baby step 1 and depending on how intense you are to budget and cut expenses, you can get there pretty fast.

But then comes baby step #2 – paying off all the debt (except for your house).

So, let’s look at this step from a practical standpoint.

Let’s say, you have about $38,000 in debt (this is the average amount in the U.S. without a mortgage) how long would that take you to pay off?

Let’s just say for funsies, you had a 0% interest rate and at your CURRENT level of income, you could only throw about $1,000 extra towards that $38,000 every month. That is $12,000 per year. That means, it would take you a little over 3 years to pay off that debt.

But here’s the thing – you won’t have 0% interest so you’ll be paying even more for even longer.

Not to mention, that more than half (57%) of Americans have less than $1,000 in savings. (Source)

If this situation sounds anything like you (high debt, low income) then you’d be perfect for Dave Ramsey’s Program – that is, if you are ready to land yourself 2-3 more jobs, sell everything in sight, move into a cheaper home, and make some crazy, very drastic changes in your life.

No, I am not be overly dramatic. This approach is known to the Dave Ramsey community as “Gazelle Intense”.

The idea is that you will be so intense with the changes in your life that you will do anything and everything you can to get yourself out of this situation. Even if that means you are working 12+ hour days for months or even years. The approach is meant to make you uncomfortable and work hard so you pay off this debt and never get into this situation again.

And yes, people do this and honestly that is AWESOME that they do.

But, what happens if you are like the many American’s that are older, disabled, unable to work, have health issues, are a single parent with young children at home just trying to make ends meet, or really, have any other reasonable excuse as to why getting more jobs isn’t the answer?

Let me be clear, I AM NOT MAKING EXCUSES for anyone in this situation.

But there are several reasons why someone can’t just have land a job and get to making buttloads of money to pay off debt.

And that is my issue with this dated approach.

It leaves no room for people to have another way out so, they continue to drown in debt for the rest of their lives and I am just not okay with that.

Everyone in any situation in life has the right to get out of debt and have the opportunity to build wealth.

So, while I do talk a lot about Dave Ramsey’s Total Money Makeover and Financial Peace University, I realize it is not for everyone.

Dave Ramsey is brilliant and he surely knows what he’s doing but remember, even he didn’t follow his baby steps, at least not in the beginning.

He filed bankruptcy and who’s to say that if he hadn’t, he’d be where he is today.

No, I am not saying bankruptcy is the answer either but it is an OPTION.

Just like choosing another method like consolidating your debt, the avalanche method, etc. are all options (I’ll explain all of those options further in another post).

My point is, I don’t want people stressing and believing that this is the only way out of debt because it’s not.

Sure, you can go and try to post your life story into the Baby Steps Community or call Dave up and tell your story in 30 seconds but unless he and anyone in that community is living your life, they don’t truly understand. There are people who can relate, but they are NOT you.

The last thing I want to see is anyone killing themself over trying to fit into this perfect mold of doing things the way Dave Ramsey says simply because they believe it is the only way because it’s not.

Again, his advice is solid if it fits your lifestyle and situation (which for most people it does).

If his program is the best for your situation, great! Follow his advice and his steps and you’ll be out of debt as long as you put the effort in.

But, if it doesn’t work, that is okay too. There are other ways out of debt. There is light at the end of the tunnel, this way just may not be it.

And if you need support, I am here to tell you that it is okay and you will be okay.

So, take a deep breath and let’s try to find the perfect situation suited best for you!