The 52-week money challenge is an easy and effective way to save money, making it a great New Year’s resolution. This savings plan can help you build a significant emergency fund or save up for specific financial goals like a down payment on a home or paying off credit card debt over the course of a year.

Here’s how to get started and maximize your savings throughout the year.

What is the 52-Week Money Challenge?

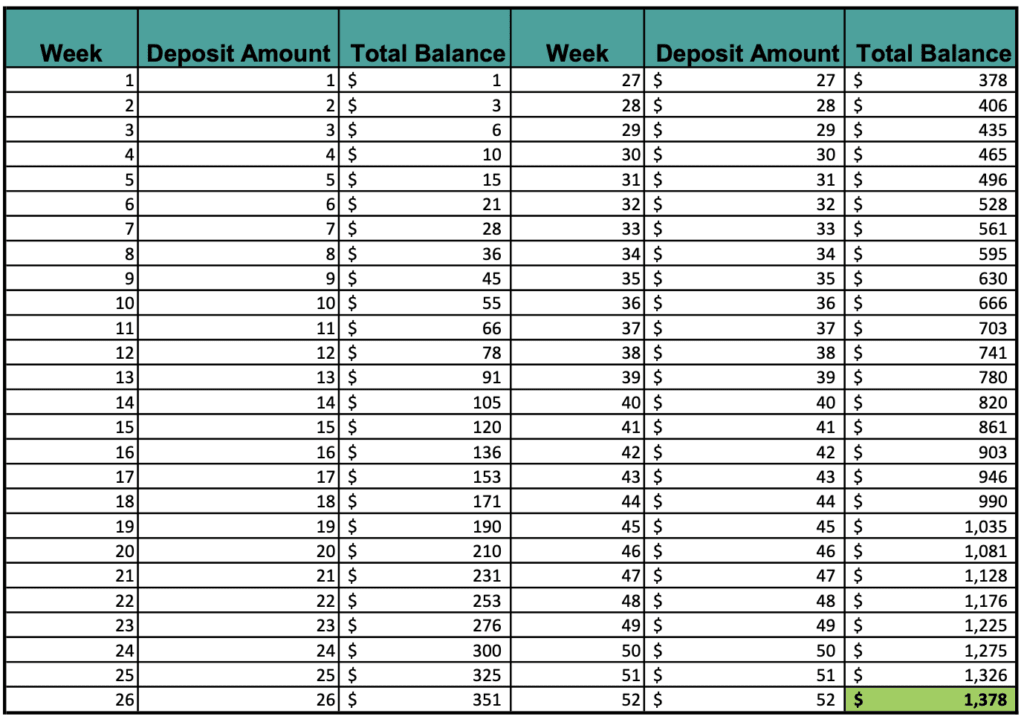

The 52-week money challenge involves setting aside an increasing amount of money each week for the whole year. In the first week of the challenge, you save $1, and with each subsequent week, you increase your savings slightly. Week 2 is $2, week 3 is $3 and so on. By the last week of the year, you’ll have saved a sizable total amount – a total of $1,378!

How to Do The 52-Week Money Challenge

Step #1: Pick a savings account. You’ll need to decide where you want to save your money. You can choose a simple savings or checking account at your local financial institution. But if you want to earn extra money, consider choosing an account with a high interest rate such as a money market account or a high-yield savings account. Some online banks also offer competitive rates so it’s worth taking the time to research the different options.

Step #2: Begin saving your money. Start with week 1 and add the correlating amount into your savings account. This money challenge is typically started at the beginning of the year but you can start at any time. You can even work the challenge backwards starting with week 52 and finishing with week 1.

Easy Ways to Stay on Track

Set Reminders

Life gets busy, so set reminders to ensure you don’t forget your weekly savings. Use your phone, a simple piggy bank on your bedside table, or any method that works best for you. You can also use this Free 52 Week Money Savings Challenge Printable to help you keep track.

Automatic Transfers

Consider setting up automatic transfers from your checking account to your savings account. This is one of the best ways to ensure you stick to your savings plan without having to remember to transfer money manually every week. It will be such small amounts, you’ll hardly notice the money is gone.

Monitor Your Progress

Keep track of your savings and celebrate small milestones. Watching your emergency savings grow is a great motivation to keep going.

Nearing the End of the Challenge

Adjust as Needed

If you find the increasing amount of money challenging to keep up with, don’t be afraid to adjust. The goal is to save as much money as possible, not to stick rigidly to a plan that doesn’t fit your financial situation.

Plan for the Highest Amount of Money

The last week of the year will see you saving the highest amount. Plan for this by budgeting in advance, especially considering the holiday season.

End of the Year: Reaping the Rewards

Evaluate Your Total Savings

At the end of the year, look back at how much you’ve saved. This large sum can be a great boost to your emergency fund, help pay down debts, or contribute to a larger financial goal.

Plan for Next Year

Reflect on what worked and what didn’t. Perhaps next year, you can try a different amount or a new savings strategy, like even-numbered savings amounts or a step-rate CD.

If you’re looking to increase your savings amount for the following year, give the 100 envelope challenge a try!

See The 52-Week Money Challenge as a Stepping Stone

The 52-week savings challenge is more than just a way to save money; it’s a lesson in discipline and financial planning. It’s a simple, creative way to make significant financial changes over the course of a year. With each week, you’re not just saving money; you’re building habits that can lead to long-term financial stability and success. Good luck, and remember, the best time to start is now!