If you are just starting to budget your money, beginning with a simple budget system is the best way to help keep you on track. One of the best budgeting methods (that is also wildly popular on social media) is known as the 50 30 20 budget rule. So, let’s discuss exactly what this budget method is and how to do it.

Looking for more budget ideas? Check out our 100 Envelope Savings Challenge, 200 Envelope Savings Challenge, 50 Envelope Savings Challenge, 52 Week Savings Challenge and even information Sinking Funds.

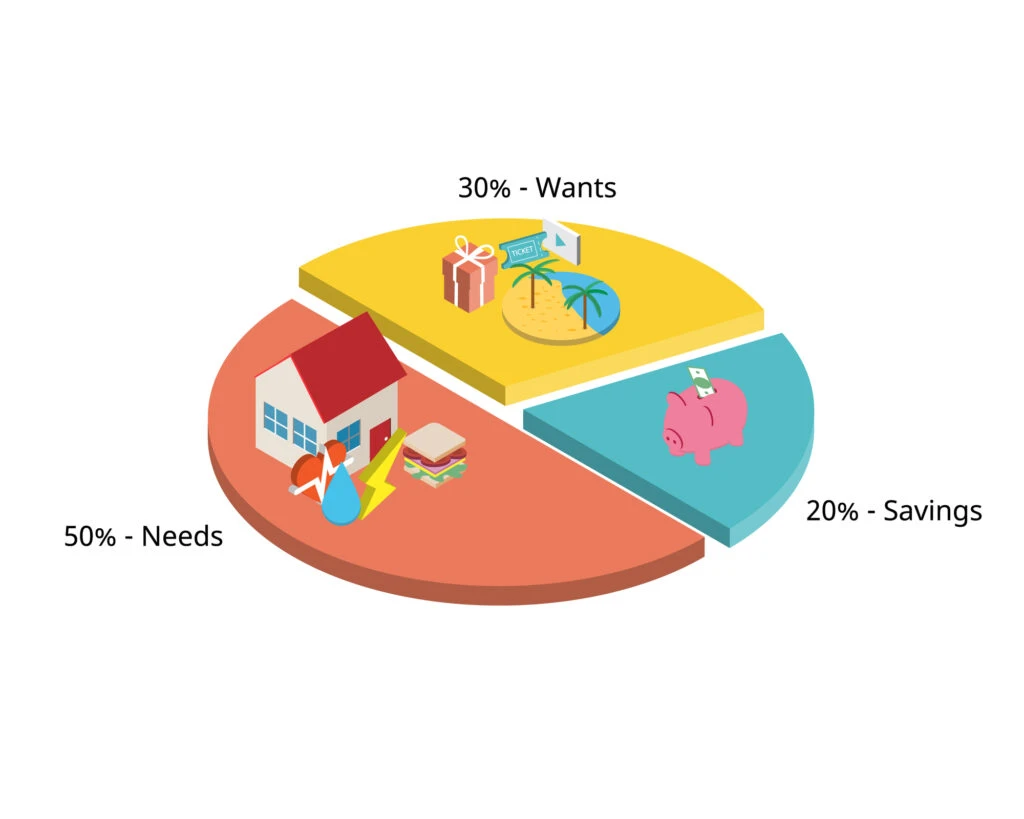

What is the 50 30 20 rule?

The 50 30 20 rule is a method in which you divide your income into three main categories for budgeting purposes. 50% goes to your needs, 30% goes to your wants and 20% goes to your savings and investments.

How to Do The 50 30 20 Budget Rule

Calculating your 50 30 20 budget is simple and can be done on a monthly or yearly basis. Once you’ve determined whether you’ll calculate it, monthly or yearly, you’ll need your income and expense information.

Gather all of your income sources. If you are married or have a partner that you share household expenses with, you’ll want to have income information for the both of you. This income should be calculated using your income after taxes.

For example, if you make $50,000 per year (after taxes) and your significant other makes $50,000 per year, you have a combined household income of $100,000 that you’ll use for your 50 30 20 budget plan.

Once you’ve gathered your income, you’ll want to divide your income into the following categories:

- 50% Essential Expenses: These are expenses that are necessary for your basic needs, such as housing, groceries, utilities, and transportation.

- 30% Non-Essential but Important Expenses: These are expenses that are not essential to your basic needs, but are still important for your overall well-being and happiness. Examples might include dining out, entertainment, and gifts.

- 20% Savings and Investments: The remaining 20% of your income should be set aside for savings and investments. This can include things like an emergency fund, retirement savings, and investments in stocks or real estate.

An example of the 50 30 20 rule

Let’s use the $100,000 combined household income as an example for the 50 30 20 rule.

This means that:

- 50% – $50,000 would go to the essential expenses

- 30% – $30,000 would go to the non-essential but important expenses

- 20% – $20,000 would go to the investment/savings category

So, in a year’s time you shouldn’t go over $50,000 in essential (needs) expenses and a minimum of $20,000 should be put into your savings or investment accounts a year.

What if you go over the 50 30 20 rule?

The idea of this budgeting method is that instead of trying to just pay all your bills and hope any leftovers can go towards paying debt, fun or even just savings, you are trying to just work with the income you actually have.

This means the goal is, you budget down so tight into these categories that you cannot go over that percentage in a given year or month.

Going over simply means you are negative on your income and your expenses for these categories exceed your income putting you into debt. The only way to get out of it is to lower your expenses in these categories or to raise your income.

Tips for Sticking to Your 50 30 20 Budget

Once you have calculated your 50 30 20 budget, it’s important to stick to it as closely as possible. Here are a few tips to help you do so:

Create a budget plan and track your expenses: One of the best ways to stay on track with your budget is to create a detailed budget plan and track your expenses on a regular basis. This can help you identify areas where you might be overspending and make adjustments as needed.

Cut unnecessary expenses: Take a look at your budget and see if there are any expenses that you can cut or reduce. This could include things like subscription services, cable television, or expensive gym memberships.

Look for ways to save money: There are plenty of ways to save money on essential expenses. For example, you might consider shopping around for the best prices on groceries or looking for ways to reduce your utility bills. Even shop around for insurance policies by obtaining quotes.

Be flexible: Finally, it’s important to be flexible with your budget. If something unexpected comes up, you may need to adjust your budget to accommodate it. Just be sure to stay within the 50 30 20 framework as much as possible.

I also made this handy 50 30 20 Rule Printable for you to help keep you on track. Simply download and print it and use it monthly!

Conclusion

The 50 30 20 budget rule is a simple but effective way to manage your finances and achieve long-term financial stability. By dividing your income into essential, non-essential but important, and savings categories, you can make the most of your money and reach your financial goals. With a little planning and discipline, anyone can follow the 50 30 20 budget rule and enjoy a more financially secure future.