If you are looking for an easy way to jumpstart your savings this year, this weekly $5 Challenge is it!

How many times have you told yourself that you’d start saving and investing in your future? How many times have you talked yourself OUT of saving money but talked yourself INTO spending $10 at Starbucks?

For me, that was a reoccurring pattern, year after year. Until last year when I decided to start saving and doing less frivolous spending.

I’ve tried the 100 Envelope Challenge, The 200 Envelope Challenge and even the 52 Week Money Saving Challenge and I am giving you another idea…

The 52 Week $5 Challenge

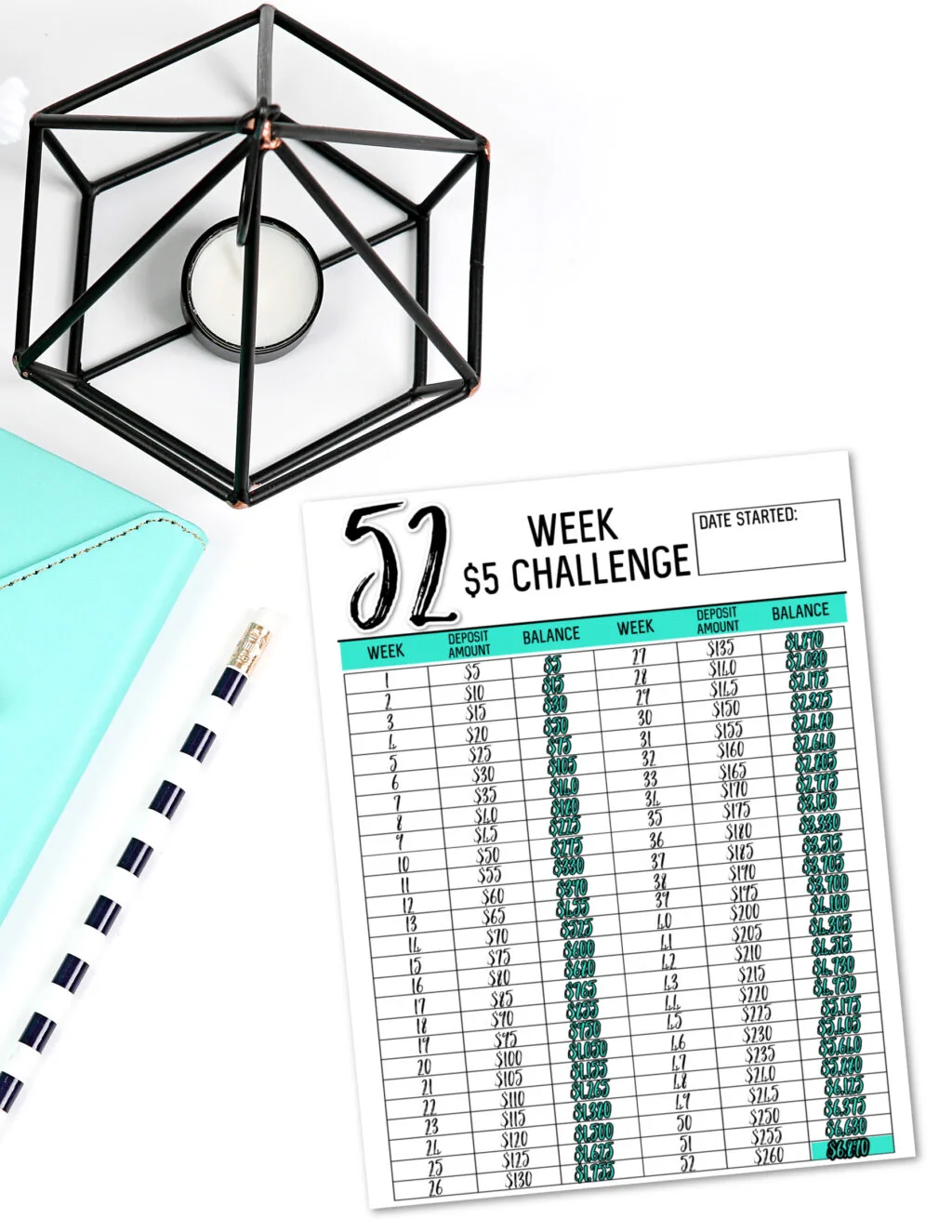

The 52 Week $5 Challenge helps you start saving money by giving you an attainable goal of saving $5 then increasing each week’s savings amount by $5. By the end of 52 weeks, you will have saved $6,890!!

How Does The $5 Challenge Work?

For the 52 Week $5 Challenge, you will start on week 1 by saving $5. Then week 2 you will add an additional $5 so you will save $10 that week. And so on.

Week 52 you will save $260 which will give you a total savings balance of $6,890.

I even made an easy 52 Week $5 Challenge Printable you can use to help keep track of the amounts and balances.

While the later weeks may seem like they are quite hefty, keep in mind that as weeks go on you can adjust your spending habits, budget and even obtain side hustles to help put these amounts away. You’d be surprised how easy it is to save an additional $5 each week when you are actively looking at your income and spending habits.

By now you might be asking yourself, “What if I don’t have enough money to do the challenge?”

Trust me, I know how this goes.

First off, keep in mind these money saving challenges are not meant to make you broke or put your finances in a world of hurt.

While these money saving challenges are fun to complete and they are a huge financial accomplishment, they are just that.

Once you decide you want to participate, my best two tips to help you save are to:

- Get on a strict budget – This will help you see where the money you make is going and help make adjustments to save more money. What ever is left after your bills are paid, you can give it a purpose (to save) utilizing a money saving challenge like this one.

- Increase your income – You can do all sorts of things to make extra money including side hustles, working overtime, selling things on Facebook Marketplace, etc. Get creative and see ways you can make some extra moolah. Once you start it, it very quickly becomes an addiction.

This $5 Challenge is quite straightforward but if you have any questions feel free to ask them below!

Happy saving!

Bev

Thursday 11th of April 2024

Hi, this is a little steep for some people. Myself I am retired and don’t have that kind of money for the later weeks. There are other challenges that don’t cost you that much by the end of the year.

Example : weekly challenge. Mon. $1. Tues. $2. Wed. $3. Thursday. $4. Fri. $5. Sat.$6. Sun. $7. Week two start again. By week 52 you will have saved $1,456. A little more attainable for most people.

Example: week one $1. Week two $2. Week three $3. Etc. up to week fifty-two $52. You would save $1,378.

I know it’s not as much money but a little is better than nothing.

Great idea what ever challenge you can do. By the way thank you for making me think of doing this again. Challenge is on. 👍🙂

Brittanie Pyper

Thursday 11th of April 2024

Hi Bev, I totally understand where you are coming from and I hear you! I've been working on several other money savings challenges so everyone can participate at all income levels. Another great one to try is the Penny Challenge I wrote about here: https://www.simplisticallyliving.com/penny-challenge/. I'd love to hear any additional feedback or ideas you may have on other challenges :) Thank you!

Angela

Tuesday 12th of March 2024

You lost me at week 5. I don’t have that kind of money. I already do next to nothing. So there is no extra I am spending to take away from. It’s a great concept if you have money.

Sandra

Monday 22nd of January 2024

I love a challenge

Sue

Tuesday 9th of January 2024

Yes please

Jackie

Saturday 30th of December 2023

I love this challenge! I'm starting one Jan 1,2024. It's a $5,000 challenge in a year and I'm getting my kids involved too. I think it will be fun and hold each other accountable.