While I personally believe that credit scores are sort of a scam, I also believe, you can’t do much in life without a good credit score. It’s just one of those games you have to play if you want to succeed with finances.

After all, some banks and credit unions won’t even allow you to open an account without good credit. So, it truly is a must.

With that being said, right now, so many Americans are living paycheck to paycheck and may be relying on the use of their credit cards to survive.

And if you know anything about credit, you know that your credit utilization rate plays a big part in your overall credit score.

How much does credit utilization impact credit score?

Credit utilization, also known as the balance-to-limit ratio, plays a significant role in the calculation of your credit score. It specifically contributes to the “amounts owed” category, which accounts for roughly 30% of your FICO score. FICO is the most commonly used credit scoring model.

Credit utilization ratio is calculated by dividing the total amount of debt you currently have by the total amount of credit you have available. For instance, if you have a total credit limit of $10,000 across all your cards and you’re carrying a balance of $3,000, your credit utilization ratio is 30%.

Your credit utilization also matters on a per card basis.

Generally, it’s recommended to keep your credit utilization ratio under 30%. Lower percentages (under 10%) are seen as even better. High credit utilization suggests that you may be at risk of overextending yourself and could have trouble paying back your debts, which could lead to a lower credit score.

However, credit utilization isn’t the only factor that impacts your credit score. Other factors like payment history (35% of FICO score), length of credit history (15%), credit mix (10%), and new credit (10%) also play significant roles.

Simply put: high credit card balances can hurt your credit score and scare off potential credit lenders.

The Easiest Way to Boost Your Credit Without Paying off Any Debt

So now, you’re probably wondering – okay, this is great to know but how can I help boost my credit score when I don’t have the money to pay off those cards?

I have one simple solution to try and it will only take a few minutes of your time…

Increase your credit card limit.

How do I increase my credit card limit?

All you need to do is, login to your credit card account and the majority of credit card issuers, offer a button that says “credit limit increase” or some variation of it.

Most of the time, you will be asked to provide your income (especially since this can change often) and sometimes you can even ask for the credit limit you are seeking.

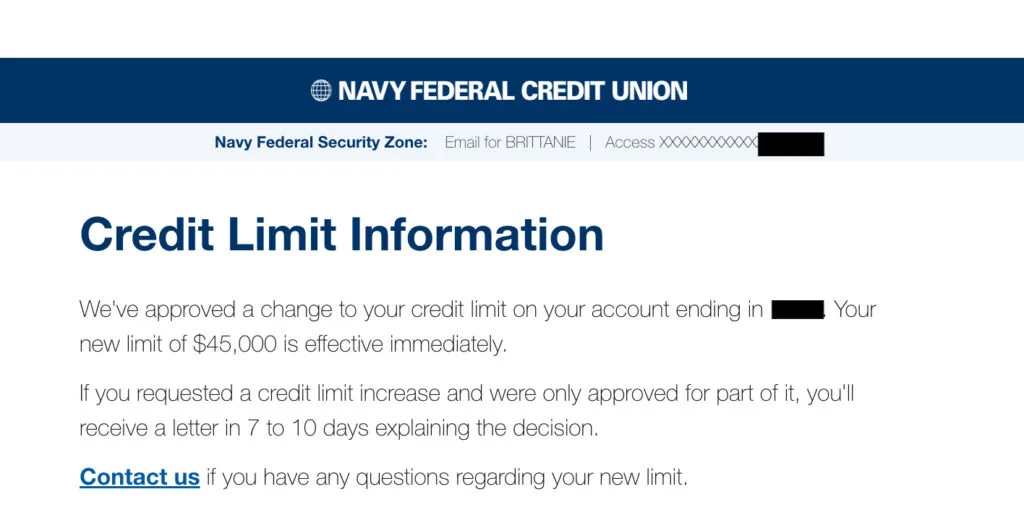

For example, one of my credit accounts is with Navy Federal Credit Union. I am able to request a credit limit increase within my account online. I then submit it and hear back within 24-48 hours.

Here is the email I received after a recent credit limit increase request:

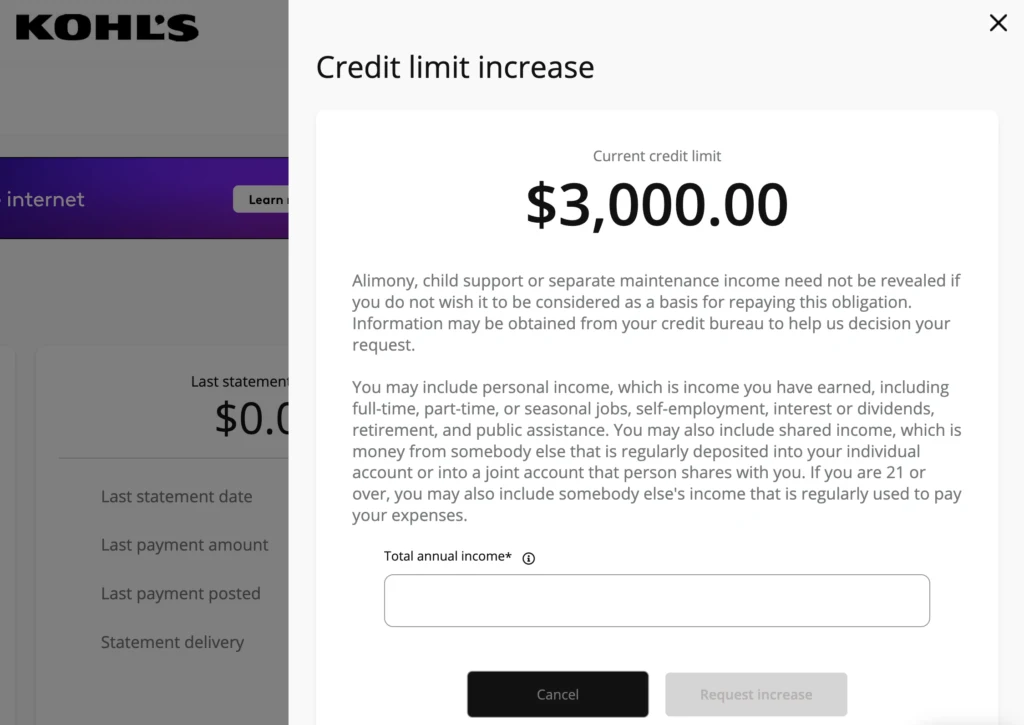

Other retailers such as Kohl’s, allow you to get an immediate response online. Kohl’s isn’t as giving when it comes to credit limits but I was just granted an increase of $3,000. Their online process looks like this:

How does increasing your credit limit help your credit score?

Increasing your credit limit can potentially help your credit score by reducing your credit utilization ratio, assuming your spending doesn’t increase.

As explained earlier, your credit utilization ratio is the amount of credit you’re using divided by the total amount of credit you have available. A lower utilization ratio can positively impact your credit score.

So, if your credit limit increases and your spending remains the same or decreases, your utilization ratio will be lower.

For instance, if you’re carrying a $2,000 balance and your total credit limit increases from $4,000 to $6,000, your utilization ratio decreases from 50% to about 33%. Overall, this can help boost your score!

The important thing here is, to also not use that extra credit. Raise your limit and then continue making payments on those cards so the balances continually decrease helping your credit utilization each month.

However, keep in mind that asking for a credit limit increase might lead to a hard inquiry on your credit report, which could slightly lower your score temporarily. Also, while having more available credit can be good for your credit score, it also means you have the ability to accumulate more debt, which can be a risk if not managed carefully.

The best way to know if the company will run your credit is to ask. I haven’t had that issue with anywhere else besides Ulta beauty for some reason. Everywhere else just asks for my income.

Anytime I’ve personally done this, I’ve boosted my score 5-10 points. It does take 30+ days to report and reflect on your credit report but it is a free way to do it.

How often should you ask for a credit limit increase?

Personally, I try a credit limit increase on my cards every 30-90 days because the reality is, the worst they can say is no.

So, if you are looking for a cheap and easy way to boost your credit score, try asking for credit limit increases. It is often able to be done online or over the phone and just takes minutes. The time you take could result in a higher credit score that can help you get one step closer to your financial goals.