As we welcome the new year, many of us set financial goals, and what better way to achieve them than with a fun and effective money-saving challenge?

The 2024 Money Savings Challenge is designed to help you save $600 over the course of the year!

This challenge is a great way to build your emergency fund or save for personal use, and it can easily be integrated into your life with minimal effort. So, let’s talk about how to get started…

What is the 2024 Money Challenge?

The 2024 money challenge is a fun money savings challenge designed to be completed in the year 2024. It is completed by saving $24 for a total of 25 times for a grand total of $600 in savings.

While $600 may not seem like much, it could mean a lot to someone and it can even be a great stepping stone to help you begin your savings goals.

How to Do The 2024 Money Challenge

Begin by deciding whether you want to do the physical cash method (by keeping cash stored away safely at home) or if you want to do the digital method (saving in a dedicated savings account such as a yield savings account).

Once you’ve decided which method you are going to use, you simply begin with saving $24. You can choose any day of the week and you can choose how fast you reach your savings goal. It can be done daily, weekly or monthly (to fit your budget).

How to Keep Track of Progress

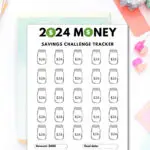

I made you a Free Printable 2024 Money Savings Challenge tracker (for personal use only) to help you keep track of your savings progress.

Every time you complete a $24 savings, color in one of the number 24’s. Complete and color them all in to reach your $600 savings goal.

Benefits of the 2024 Money Savings Challenge

- Achievable Goals: Saving $24 twenty-five times a year is a simple and less intimidating approach compared to some harder versions of money-saving challenges.

- Flexibility: This challenge offers flexibility, allowing you to adjust your savings days according to your pay schedule or financial situation.

- Builds Financial Discipline: Regularly setting aside money helps develop a habit of saving and makes you more conscious of your spending.

By the final day of the year, you’ll not only have saved $600, but you’ll also have developed a sustainable habit of saving.

Remember, the end of the challenge is just the beginning of your journey towards financial security and achieving your long-term financial goals.

Whether it’s using the Etsy app for personalized advertising to save on purchases or exploring different savings options like money market accounts, every small step you take is a move towards a more financially secure future. Let the 2024 Money Savings Challenge be your gateway to a healthier financial year!

Other Money Savings Challenges

- Penny Challenge – You can save nearly $700 for the year!

- 50 envelope money savings challenge – You can save $1,275 over 50 days.

- 100 envelope challenge – You can save $5,050 in 100 days!

- 200 envelope challenge – You save $5,000 in 200 days!

- 6 week Christmas savings challenge – You can save $500 in 6 weeks before the holidays.

- 52 week $5 challenge – You save $5 each week (increasing it by $5 weekly) and save ovfer $7,000 in a year